irs unemployment tax break refund status

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. The IRS has sent 87 million unemployment compensation refunds so far.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

IR-2021-151 July 13 2021.

. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. The federal tax break went into effect following the recent changes made by the American Rescue Plan. Some are reporting on social media that theyve received IRS updates on their tax transcripts.

The IRS is starting to send money to people who fall in this categorywith more refunds slated to arrive this summer. The Irs Will Begin Issuing Refunds In May For An Unemployment Tax Break By Tara Siegel Bernard Taxpayers who received unemployment benefits last year but who filed their federal tax returns before a new tax break became available could receive an automatic refund as early as May the Internal Revenue Service said on Wednesday. What are the unemployment tax refunds.

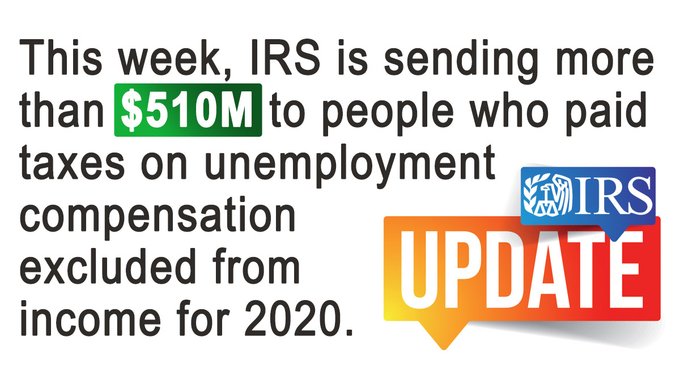

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. The Internal Revenue Service will begin refunding money to people in May who already filed their returns without claiming the new tax break on unemployment benefits the agency said Wednesday. WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. April 1 2021 1136 AM 4 min read. You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. According to senior fellow and. The IRS has sent letters to taxpayers.

If you received unemployment benefits last yearyou may be eligible for a refund from the IRS. The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

Check For The Latest Updates And Resources Throughout The Tax Season. 22 2022 Published 742 am. But the unemployment tax refund can be seized by the IRS to pay debts that are past due.

By Anuradha Garg. Irs Sends 430000 Additional Tax Refunds Over Unemployment Benefits. The unemployment tax refund is only for those filing individually.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Still waiting to get a refund from the IRS for taxes you paid on 2020 unemployment benefits. IR-2021-159 July 28 2021.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. The last batch issued by the tax agency was in late July and totaled 15 million refunds.

The first10200 in benefit income is free of federal income tax per legislation passed in March. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

This includes unpaid child support and state or federal taxes. Last year the government imposed no taxes on those who received up to 10200 of benefits in 2020 as part of the COVID-19 relief law the American Rescue Plan Act. The IRS breaks it down If your modified adjusted gross income is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200 The IRS states on its website.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. So far the refunds have averaged more than 1600.

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Notice Cp81 Tax Return Not Received Credit On Account H R Block

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

Irs Refund Status Unemployment Refund Schedule Is Delayed Marca

Tax Season Is Not Over Until You File Tackk Tax Season Tax Services Tax

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Don T Make These Tax Return Errors This Year

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money

Irs Unemployment Tax Refunds 4 Million More Going Out This Week King5 Com

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money Personal Loans Loan Types Of Loans